Our place to share ideas

Decoding China Real Estate Market.

One of the main drivers of Chinas economic growth was the development and financing of Real Estate products at a big scale. This allowed for job creation (which affects consumption coming from wages), infrastructure development (that incentivises property appreciation), and the birth of new clusters of economic development. This all sounds like positive effects in any economy, but what about if it is not sustained by the appropriate demand for Real Estate spaces?

The visible consequence of a low or inexistent demand produces deserted cities just like the one reported by our colleague in Beijing Xin Zhou on this story {NSN N7TMGD6S972R<Go>}. This deserted replicas of Manhattan, London or Paris, also represent a sunken investment that slowly eats up the Developers’ return, pushing it to negative leverage territory where debt service eats away any upside potential. This should be a reason for concern not only for Chinese policy makers but to the global community given the impact that a flop of the real estate market in China can cause in the global financial system. But just how close is this sector to free fall? First of all we have to consider that this is not something new as we can attest by this piece published in 2010 {NSN NMK0A36K50YB<Go>} so the effects of this deserted cities have now permeated to other indicators and instruments inside the financial markets. This influence can provide some light to the situation considering the difficulties to obtain reliable macro-economic data for China.

It is the purpose of this piece to provide a base of analysis, in order to identify and share with our clients, for them to identify the increased risk (in the short term) that the Real Estate sector in China is exposed to by the markets pricing of its debt.

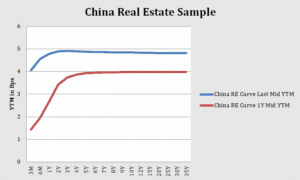

We start off by taking as a sample the bonds issued by the companies members of the {BICHODCP Index} through the use of {SRCH<GO>}. We can call that search on functions such as {CRV <GO>} to create a fitted curve and be able to analyse its change historically.

By comparison of the same sample, we can see how the curve in one year has inverted drastically with yields on the short end surging more than 100 bps.

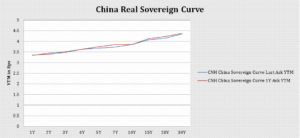

In contrast, despite the increase in sovereign yields on the short term, the sovereign curve seems to maintain a normal slope against what we see in the RE Sector, this suggests that there is an expectation of increased risk in the short term.

And this makes sense if we consider that the industry has already showed signals of slowing down developments, that have send shockwaves to the demand for metals globally. Let’s think about it this way, Developers fund their construction with Equity and Debt (traditionally more than 50% in terms of LTV) this is made to boost returns and to free capital to engage in even more projects. Their source of income is the cash flow coming from rent or the purchase of a space (residential or commercial). If the cash flow stagnates, because there is no demand for this spaces, returns evaporate and it becomes more difficult to service debt for these companies making its debt more risky to hold or investors demanding a higher compensation for the risk they are bearing.

If we load our search on {FIW<GO>} and plot in terms of its OAS spread we can see there is congruence with the previous data, particularly for Sr Unsecured debt which represents the vast majority of the sample. This further shows an increase in the perception of credit risk in the short term for the sector.

All this leaves us with one final question, who are the debt holders for this sector which are exposed to this risks of failing to collect these obligations? Again, if we return to our search on {SRCH<GO>} go to our Results and to the Holders tab we can then see just how this situation is not only relevant for the Chinese government, but to governments all across the globe.